Article

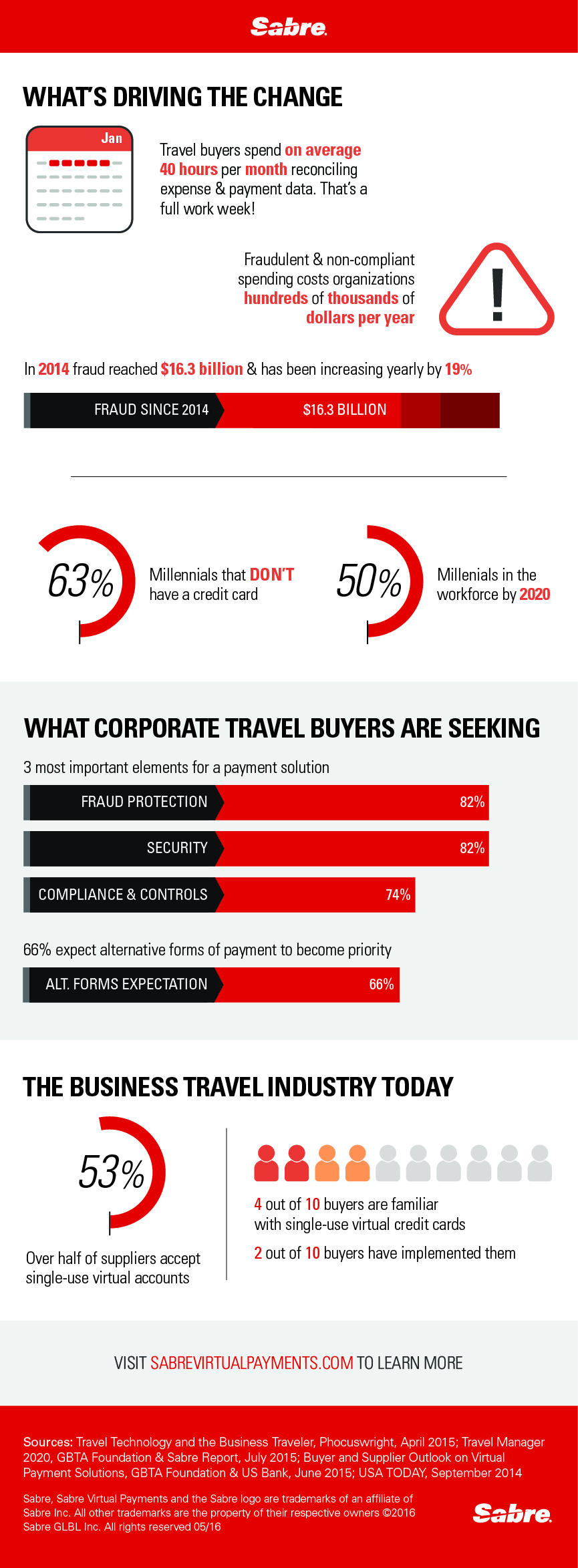

19%: This one number is why you can’t afford to ignore virtual payments

Rachana Khanzode

on

May 11, 2016

Rachana Khanzode

on

May 11, 2016

- Agencies & OTAs

- Airline Industry

- Airline Retailing

- Artificial Intelligence

- awards

- Bleisure

- Business Transformation

- Celebration

- Cloud Computing

- Corporate Social Responsibility (CSR)

- COVID Response

- Culture

- Customer Experience

- Customer Testimonial

- Data & Analytics

- Developers & Startups

- Diversity

- Engineers

- Events & Programs

- Global Capability Centers

- Hiring

- Hospitality Industry

- Innovation

- Internet Of Things

- Interns

- Interview

- Leadership

- Learning and Development

- Mobility

- NDC

- partnership

- Product Management

- Security

- Service Anniversary

- Strategy

- Sustainability

- Technology

- Technology Transformation

- Testimonials

- Travel Technology

- Traveler Experience

- Web 3.0

- Women in Technology

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Print page

Related Post

-

Article

July 13, 2023

Unlocking Potential: My Transformative Mentorship Experience at Sabre

Enrolling in the mentorship program at Sabre was a decision driven by my eagerness for personal and professional growth, particularly in the field of product management. I was seeking guidance and mentorship from seasoned professionals who...

-

Article

April 6, 2023

Learnings from The Big Pitch – Global Edition

Learning is a continuous journey and the recent ideation event – The global Big Pitch 2023 was an incredible experience that was equally challenging and rewarding. To give you a quick view into its extent, the...

-

Article

October 19, 2022

Sabre’s successful partnership with The/Nudge Foundation and The Apprentice Project

Sabre believes giving back to the community is an amalgamation of two kinds of contribution – people and capital. Depending on the requirement, we, at Sabre Bengaluru Global Capability Center, contribute by either funding a project...

-

Article

July 5, 2022

My Internship Experience with Sabre

When I joined Sabre, I was quite excited and nervous at the same time because it was going to be my first experience in the corporate world. Six months later, I am glad that I chose...

-

Article

May 13, 2022

Day in The Life of a Product Manager – Part 2: Krishna RKS

Not all days are alike for a Product Manager, yet there are some common themes that cut across. Through this article, I share how a day in my life looks like. If some of the inputs...

-

Article

April 22, 2022

Approach for CI-CD in Machine Learning: A Retail Intelligence Use Case

An enterprise application software is composed of multiple layers, components and verticals. While until most recently, the foundations of these systems comprised of elements like databases, web-engines, MQs, User interface etc., machine learning based sub systems...

-

Article

March 29, 2022

Day in The Life of a Product Manager – Part 1: Sushant Mathur

If you ask a Product Manager (PM) to describe a typical day at work for them, their first response will be that ‘every day is different!’. Although that response may sound vague, it is true in...

-

Article

February 17, 2022

Introducing NIMBUS – Open Source Functional Test Automation Framework

The NIMBUS journey started four years back, right after the Lodging team based in Bengaluru grew from a handful of team members to close to a 100.This team was tasked with building a next-generation lodging platform...