According to the China Air Transport Association (CATA), China’s aviation has been recovering rapidly in Q1 and has seen the return of near pre-pandemic levels. Sabre has sifted once more through data to examine the effects of reopening at the 4-month mark. Key findings include:

- Continuous surges for shopping and booking with restrictions easing further.

- More inbound than outbound trips; however, outbound trips are bouncing back faster than inbound trips.

- Longer length of stays still preferred for outbound trips but an increase for outbound trips of less than three days observed.

- Increase in international capacity in Q1 mainly for routes with North Asia; March 2023 fares generally lower than January 2023.

Continuous surges for shopping and booking with restrictions easing further

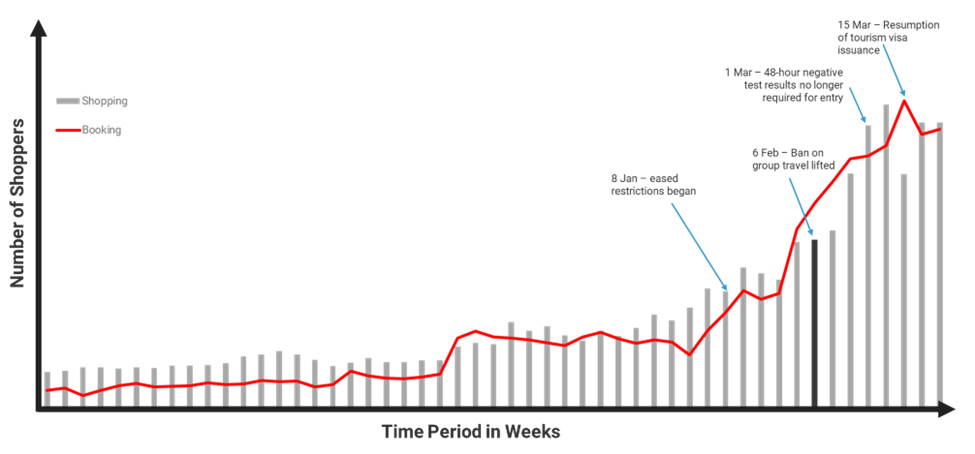

In our previous China report on the impact of reopening, we recorded that there were significant spikes in shopping and booking requests on December 26, January 8, January 20 and February 6. Our latest insights show that there were further spikes on March 1 for shopping, when the 48-hour negative Covid test results were no longer required for flying inbound to China, as well as on March 15, when China resumed the issuance of all types of visas, including the long-awaited tourism visa, to foreigners.

Increase in searches (grey) & bookings (red) through March 31 for inbound & outbound China routes

More inbound than outbound trips; however outbound trips bouncing back faster than inbound trips

As of May 4, there has been a shift between the number of inbound and outbound trips. There is now a greater percentage of inbound than outbound trips, with inbound taking up 59.8% of all trips. However, outbound travel is still recovering at a faster rate than inbound when compared to pre-pandemic levels, given that the entry requirements and tourism visa issuance changes were only made in March.

The top 5 destinations as of May 4 for Chinese outbound travel wereJapan, Thailand, Taiwan, the United States and Korea, with Thailand rising from 3rd place in 2019 to 2nd place in 2023. The top 15 destinations in 2023 are now the same as in 2019, although the placings have slightly shifted,

| Top Destinations in 2019 | Top Destinations in 2023 | ||

| 1st Place | Japan | 1st Place | Japan |

| 2nd Place | Taiwan | 2nd Place | Thailand |

| 3rd Place | Thailand | 3rd Place | Taiwan |

| 4th Place | Korea | 4th Place | United States |

| 5th Place | United States | 5th Place | Korea |

| 6th Place | Australia | 6th Place | United Kingdom |

| 7th Place | Singapore | 7th Place | Singapore |

| 8th Place | Indonesia | 8th Place | Canada |

| 9th Place | Canada | 9th Place | Philippines |

| 10th Place | United Kingdom | 10th Place | Indonesia |

| 11th Place | Philippines | 11th Place | Australia |

| 12th Place | Malaysia | 12th Place | Vietnam |

| 13th Place | Vietnam | 13th Place | Italy |

| 14th Place | Italy | 14th Place | Malaysia |

| 15th Place | Germany | 15th Place | Germany |

Longer length of stays still preferred for outbound trips but increase for outbound trips less than 3 days observed

We previously reported that outbound travelers were opting for longer stays post-pandemic, with trips longer than two weeks taking up 21% of all trips, when compared to 2019 levels at 14%, possibly due to travelers visiting family opting to make the most out of the trip after length periods apart.

This lengthy period of stay continues to take up a significant percentage of all trips at 19%, an indication that travelers continue to book longer trips.

However, there has been a gradual increase in travelers opting for outbound trips of less than 3 days, with an increase of 4.5% when compared to 8.5% in early February, where the increase was seen only with travelers taking trips longer than two weeks. With more travelers taking shorter outbound trips, this indicates that this could be the slow but steady beginning of traveler behaviour shifting back to pre-pandemic patterns, where trips of less than three days took up 16% of all outbound and 28% of all inbound trips.

When compared to our previous report, booking windows have also reduced, with 28% of outbound and 30% of inbound bookings being made for travel within 2 weeks by May 4, versus 21% and 14% respectively as of February 9.

Increase in international capacity in Q1 mainly for routes with North Asia; March 2023 fares generally lower than January 2023

International capacity for international routes to and from China (including Hong Kong and Macau), increased from 27% on February 9 to 44% of pre-pandemic levels at beginning of May. The increase in capacity was mainly for routes within Southeast Asia and North Asia (excluding China, Hong Kong and Macau), which increased 118% and 105% respectively.

While Greater China airlines continued to fly most of the international routes in Q1, serving 67% of the total international routes, we saw carriers from other regions starting to fly more routes, with North Asian and Southeast Asian carriers flying 12% and 14% of capacity within April versus 11% and 12% in Q1.

On average, overall fares for Greater CN travel remained high throughout Q1, and were about 1,8x higher in March 2023 versus 2019, but we saw average fares decrease to 1.5x in April 2023 vs 2019. This was seen across both outbound and inbound trips, likely linked to higher supply as more carriers restore capacity.

Data source: OAG, MIDT Sabre Market Intelligence